When starting Zetlmaier Wealth Management LLC I envisioned being a disruptor in the industry, that buzzword that tech companies throw around about how they revolutionize whatever. Financial services is a stodgy industry. We’ve seen disruptors before like Charles Schwab and John Bogle, both of whom pioneered low cost and index investing. There’s no way I expect to be mentioned in the same breath as those two. But I can steal a page out of their books and focus on what differentiates me from other advisors: fees.

Let’s talk about the basics of how things work. An advisor will create a portfolio for a client and sometimes a financial plan to go with it. That portfolio will be managed periodically for a fee which is based off a percentage of total assets in the account, typically 1%. This works well for smaller accounts. A $100k portfolio is charged $1000 per year in fees which is a good deal for the client if the advisor is putting in an appropriate amount of time managing their account. Larger portfolios become more expensive. A $1 million portfolio the client pays $10k per year in advisor fees. On a $2 million portfolio it’s $20k and so on until you get a pricing break. I had the opportunity to review a $20 Million portfolio being managed by a well-known Wall Street firm. They were charging 0.5% which equated to $100k in annual fees. The interesting thing is that firm did NOTHING differently than what I do for all my clients whether they have $500k or $5 million. This industry would have you believe that it is 10X more work to manage a $20 million portfolio than a $1 million portfolio. I disagree. Is it harder to count 100 $1 bills or 100 Benjamins? Neither, it’s the same. So why are people charged differently?

Let’s talk about the basics of how things work. An advisor will create a portfolio for a client and sometimes a financial plan to go with it. That portfolio will be managed periodically for a fee which is based off a percentage of total assets in the account, typically 1%. This works well for smaller accounts. A $100k portfolio is charged $1000 per year in fees which is a good deal for the client if the advisor is putting in an appropriate amount of time managing their account. Larger portfolios become more expensive. A $1 million portfolio the client pays $10k per year in advisor fees. On a $2 million portfolio it’s $20k and so on until you get a pricing break. I had the opportunity to review a $20 Million portfolio being managed by a well-known Wall Street firm. They were charging 0.5% which equated to $100k in annual fees. The interesting thing is that firm did NOTHING differently than what I do for all my clients whether they have $500k or $5 million. This industry would have you believe that it is 10X more work to manage a $20 million portfolio than a $1 million portfolio. I disagree. Is it harder to count 100 $1 bills or 100 Benjamins? Neither, it’s the same. So why are people charged differently?

This got me thinking about how fair that pricing structure is. Let’s say that an advisor bills their time at $500/hr. Charging $100k means they should be allocating 200 hours per year solely to that client. I can tell you with certainty that is not the case. In my estimation that client gets 1 review per year plus some regular rebalancing. Throw in the reporting requirements that the regulators put on the advisor, and I’m willing to bet that the advisor put in 20 hours MAXIMUM per year toward that client. With 10 clients like this the advisor generates $1 Million per year while putting in 200 hours worth of work. I wish I had that book of business!

This got me thinking about how fair that pricing structure is. Let’s say that an advisor bills their time at $500/hr. Charging $100k means they should be allocating 200 hours per year solely to that client. I can tell you with certainty that is not the case. In my estimation that client gets 1 review per year plus some regular rebalancing. Throw in the reporting requirements that the regulators put on the advisor, and I’m willing to bet that the advisor put in 20 hours MAXIMUM per year toward that client. With 10 clients like this the advisor generates $1 Million per year while putting in 200 hours worth of work. I wish I had that book of business!

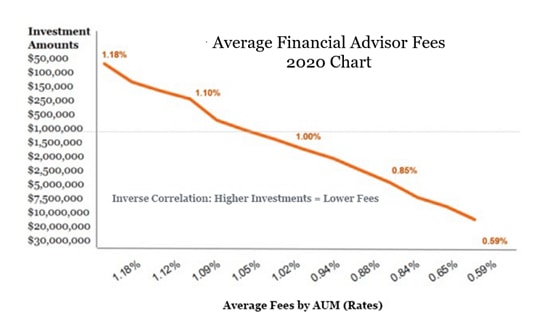

(From advisoryhq.com)

When I break it down like that, it seems very unfair to the client. Nevertheless, trillions of dollars are invested this way. This assumes 0.5% to 1% in fees. Many times fees on smaller accounts approach 2% or higher when considering the all-in costs such as underlying fund expenses. I recently started working with someone who transferred a $1 million IRA and was paying 1.75% for her investments and DIDN’T EVEN KNOW WHO HER ADVISOR WAS!!! If my new client was happy paying $17,500 in fees on her account and felt like there was a service being provided, that’s one thing. But there wasn’t any service!

When I break it down like that, it seems very unfair to the client. Nevertheless, trillions of dollars are invested this way. This assumes 0.5% to 1% in fees. Many times fees on smaller accounts approach 2% or higher when considering the all-in costs such as underlying fund expenses. I recently started working with someone who transferred a $1 million IRA and was paying 1.75% for her investments and DIDN’T EVEN KNOW WHO HER ADVISOR WAS!!! If my new client was happy paying $17,500 in fees on her account and felt like there was a service being provided, that’s one thing. But there wasn’t any service!

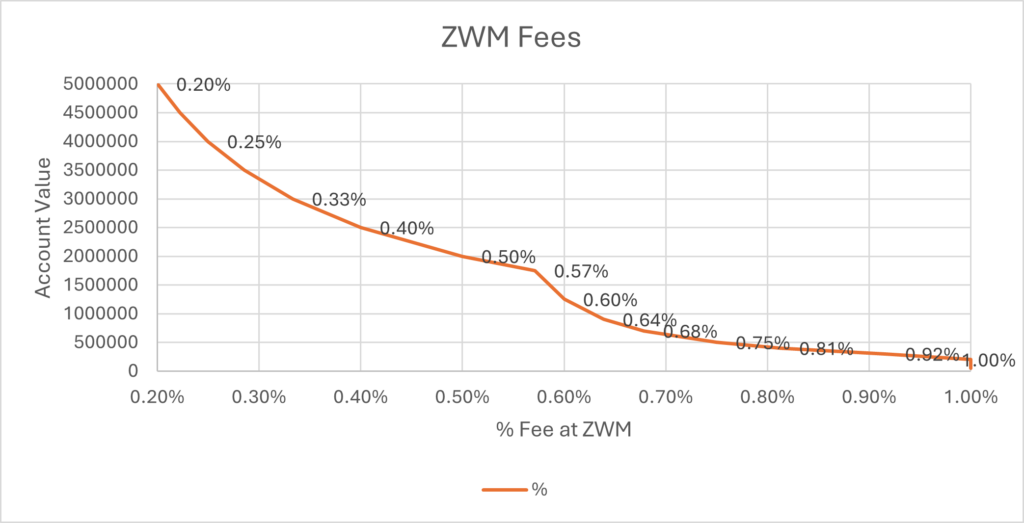

“The only time I hear from my advisor is when they want to sell me something or need to send me a bill.” I see and hear these stories all the time. This is where becoming a disruptor comes in. I want to make money (obviously) but feel like I’m providing exceptional value. Value needs to start with a cost/benefit analysis. Look at many advisor websites and you have to dig for fee information if it’s listed at all. I want to lead with fees. The fee schedule at ZWM is 1% on the first $250k in assets and 0.5% on anything above that. Once a family has $1.75 million under my management the fee is capped at $10k per year. If I value my time at $250 per hour I can comfortably dedicate 40 hours per year to that client which should be more than enough. With this, a client is getting a financial plan, ongoing financial management beyond just rebalancing accounts, and a level of personal service that’s hard to find these days.

Across the fee spectrum I’m lower than the averages, considerably lower for higher dollar accounts. One a client hit’s the $10k fee cap it becomes a substantial savings! Consumers need to start thinking about what they are paying and know there are other options. For my new client with the $1 million IRA I’m charging her $6,250 per year in advisor fees—much less than the $17.5k she was paying before and with actual service. I’m able to quantify my time at $250 per hour and offer her 25 hours of service throughout the year. It’s not cheap, but she doesn’t want to manage her own funds and realizes the cost benefit relative to most other firms.

Some of you might be saying, “Even your fees are too high. I can do it myself for a fraction of that cost.” This is true. Go ahead and manage your funds if you are comfortable doing so. You can do your own taxes, paint your own house, or mow your own lawn too. But do you want to? If you have $5 Million, is it worth 0.2% to pay for peace of mind and ease?

An old adage within the industry is “Fees are only important in the absence of value.” Compounding ultra high fees over time is a considerable drag on portfolio performance. Clients who leave typically don’t recognize the overall value of the service. Fees are an important component of the value though. You may love your advisor until you find out they are charging you 3%!